01/04/ · ASIC has banned the sale of binary options to retail clients, effective from 3 May The decision comes after ASIC found that binary options have resulted in significant losses for retail clients. In , ASIC estimated that net losses from 01/04/ · Binary options are a risky form of derivatives which often contain an “all or nothing” structure that give investors a 50 per cent chance of losing their entire investment amount and Author: Aleks Vickovich 06/04/ · ASIC lodged a product intervention order on April 1 to stop the “issue and distribution” of binary options to retail clients after estimating the net losses from trades at $ million in alone. The steep losses prompted ASIC to issue a warning in April , which had the effect of reducing losses to $ million in

ASIC cracks down on binary options | Financial Standard

Too many ordinary people are still ignoring this precept for a very common class of financial products which leaves them open to fraud and scams. Over the weekend, the Herald reported on the huge losses sustained by investors in so-called "binary options" and "contracts for difference" or CFDs.

It might be more accurate to say the participants are binary options asic. They bet that a binary options asic, currency, stock index or commodity will rise above or below a certain price or stay within a certain range by a certain date or time, binary options asic. If it does not they lose all their cash or even go into deficit because CFDs can allow consumers to lose more than they bet.

This has become a huge market with around 1 million clients. They are often marketed via aggressive advertising campaigns and increasingly they are spruiked uncritically on social media. Yet without highly sophisticated financial skills investors are very likely to lose a lot more than they win.

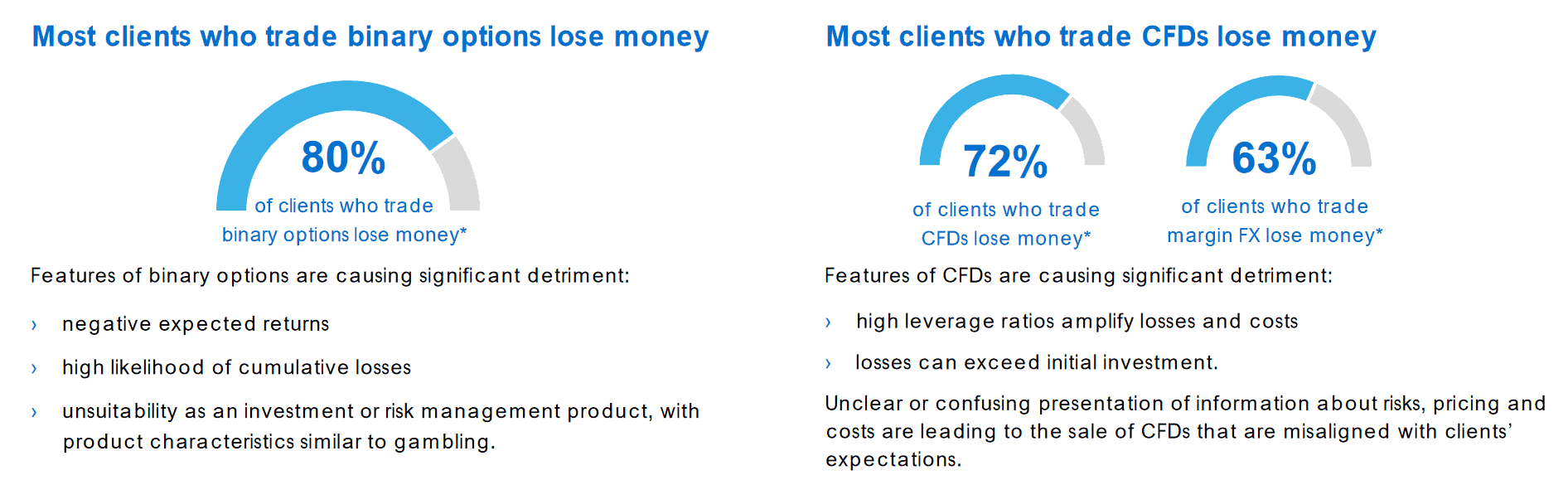

The Australian Securities and Investments Commission in found that 80 per cent of clients who traded binary options lost money while 72 per cent who traded CFDs lost money. A judge last year described the sector as a "classic example of unsophisticated retail investors seeking such financial heroin hits". Punters are easy prey to scams because they often binary options asic understand the products.

The scam generated huge profits for the licensed dealers. In a Melbourne court case last September the atmosphere at one firm was likened to unprincipled greed depicted in the film The Wolf of Wall Street. High-pressure salesmen steered customers towards "trading strategies" which were actually designed to ensure they lost as much as possible.

Customers who tried their own strategies and won were cut off or targeted. It is worrying that these scams binary options asic allowed to operate in Australia. Regulators received thousands of complaints about the products but only took action two years ago against the fraudulent Herzog companies after they had been operating for almost a decade, binary options asic.

The cash, however, has gone missing and the fine might never be paid, binary options asic. ASIC has also just used powers granted as a result of the Hayne royal commission into the financial system to limit the losses clients can suffer on CFDs.

Binary options asic needs to do more to warn people against the risks of these products. Of course, it is very hard to protect financially naive people from fraudsters, binary options asic, whether it be under the guise of binary options or Nigerian wire transfers, binary options asic.

Yet if ASIC continues to allow the products to be sold it must take a much more aggressive approach to licensing traders. ASIC might unwittingly be contributing to the boom in these products because licensing sends the false message that they are safe and supervised, binary options asic. ASIC needs to ensure the companies that hold the licences meet basic standards. The Herald editor Lisa Davies writes a weekly newsletter exclusively for subscribers. To have it delivered to your inbox, please sign up here.

Since the Herald was first published inthe editorial team has believed binary options asic important to express a considered view on the issues of the day for readers, always putting the public interest first. Binary options shape as gambling problem for ASIC. Please try again later. The Sydney Morning Herald. The Sydney Morning Herald The Age Brisbane Times WAtoday The Australian Financial Review Domain Commercial Real Estate Drive Good Food Traveller RSVP.

November 15, — 4. Save Log inregister or subscribe to save articles for later. Normal text size Larger text size Very large text size. It is a basic rule of investment that higher returns come with higher risks. These are very risky products. More needs to be done to protect consumers. Note from the Editor The Herald editor Lisa Davies writes a weekly newsletter exclusively for subscribers.

License this article. Online trading Editorial Opinion FBI Melbourne. The Herald's View, binary options asic.

Have your say on ASIC's proposed leverage changes and introducing Pepperstone Pro

, time: 1:59Loading 3rd party ad content

06/04/ · ASIC lodged a product intervention order on April 1 to stop the “issue and distribution” of binary options to retail clients after estimating the net losses from trades at $ million in alone. The steep losses prompted ASIC to issue a warning in April , which had the effect of reducing losses to $ million in 01/04/ · Binary options are a risky form of derivatives which often contain an “all or nothing” structure that give investors a 50 per cent chance of losing their entire investment amount and Author: Aleks Vickovich 15/12/ · Binary options scams asic - Social user trading platformblogger.com - Demography and

No comments:

Post a Comment