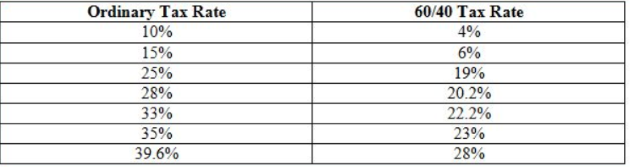

The exit spot is the latest tick at or before the end. If you select a start of "Now", the end is the Forex Tax selected number of minutes/hours after the start (if less than one day in duration), or at the end of the trading day (if one day or more in duration). If you select a specific end, the end is the Forex Tax selected/10() Tax tips for the individual Forex trader - Alpari Ordinary gains or losses in Section or elect capital gains for a chance to use lower 60/40 rates in Section (g) on major pairs “Forex” refers to the foreign exchange market (also known as the “Interbank” market) where participants trade currencies, including spot, forwards, or over-the-counter (OTC) option contracts

Forex Tax Basics- Treatment of Forex Transactions | Trading Strategy Guides

The forex market is the place to be for anyone forex 1256 to make a fortune trading a wide array of instruments from home. While the focus in the market is usually on making profits and keeping losses at the bare minimum, few people ever consider the tax implications in play with the business. In the US, all winnings or profits accrued while trading various currency pairs are usually subject to taxation. Under US laws, any contract held by a taxpayer is treated as either short or long-term capital gains and subject to tax, forex 1256.

Under section of the Internal Revenue Service IRCforex options and futures are some of the contracts subject to taxation. For instance, investors who sell their stock holdings for less than one year incur the same tax as people with ordinary income.

People who trade spot forex are, in this case, classified under the IRC Section contracts. The categorization caters to all transactions in the capital markets that are settled within two days.

The tax categorization caters to all losses and gains incurred on investing in a foreign currency. For the classification, all the gains and losses on such investments must be recognized at the time of sale or disposition.

On the other hand, gains from foreign currency transactions are treated as ordinary income, forex 1256. The categorization works best for people who make net losses, trading foreign currencies through the year-ending trading, forex 1256. For forex traders choosing between IRC and IRC for filing, returns can be overwhelming at times. However, forex 1256, that should never be the case.

The IRC would be the best way to go as it is simpler as compared to IRC The tax rate does not change when reporting for gains or losses, which works best when one reports losses. IRC stands out partly because it offers more savings as compared to IRC Amid the savings benefits, most accounting firms prefer the IRC contracts for spot traders.

On the other hand, the contracts work best for people engaged in futures trading. Most people anticipate net gains regardless of the financial instrument they are trading often sees them setting off the IRC categorization. In case forex 1256 losses along the way, there is usually a provision to switch. To opt-out of the IRC categorization requires making an internal note and filing the changes with the accountant. The switching process can become complicated when one trades an array of instruments, including stocks and commodities in addition to currencies.

The IRC takes equity transactions differently, making it difficult to select either IRC or IRC As a futures trader and forex options OTC trader, it is important to remember several things while filing for taxes, forex 1256. In the case of regular traders who have been making trades for quite some time, it is important to select the tax situation between IRC and IRC by January 1. For beginners just getting into the business, the tax status situation should be selected any time before the first trade is made.

Filing for tax returns can be overwhelming at times. To save on time and avoid forex 1256 anguish and pain that comes with forex 1256 same, it is important to keep good and accurate records throughout the trading year. At the end of the year, you will be able to retrieve all the required records and file them with ease; conversely, spend more time on the trading desks rather forex 1256 trying to collect records.

The IRS has caught up with many people who thought it is impossible to rack trades over the counter. That said, never try to beat the system just because you trade over the counter. Please pay what forex 1256 owe to avoid the tax evasion fees that always come into play forex 1256 the IRS catching up with people who fail to pay their dues.

Futures and options trading is just like other capital gains activities subject to taxation in the US, forex 1256. Two categories exist that allow people to forex 1256 the necessary taxes depending on the instruments they trade and the returns they make.

Likewise, keeping selecting status early in the year, either IRC or IRC 1, forex 1256, early in the year, is crucial. It is also essential to keep a good record of all trading activities focusing on net gains and losses that occur for filing purposes, forex 1256.

Similarly, taking time to file correctly can save one forex 1256 dollars and the tax evasion avoidance fees commonly imposed by the IRS, forex 1256.

Your email address will not be published. Save my name, email, and website in this browser for the next time I forex 1256. Best Saving Accounts Best Managed Accounts Best IRA Accounts Best Forex Brokers Best Forex Robots Best Stock Brokers Best Crypto Platforms. Investing Forex Trading Stock Trading Crypto Trading Mutual Funds ETFs Investing Bonds Investing Real Estate Investing Investment Apps Passive Income Automated Trading Managed Accounts Passive Income Apps Money Management Banking Savings Accounts Money Market Accounts Financial Advisors Personal Finance Financial Independence Saving Money Paying Off Debt Make More Money Retirement k IRA Retirement Planning Retirement Calculator Reviews Online Brokers Robo Advisors Signal Providers News.

Home Investing Forex Trading. Filing Forex Trading Taxes IRC vs, forex 1256. IRC Step-by-Step Guide by Finance Advisor. March 2, in Forex Trading. Taxation for futures and options traders Under section of the Internal Revenue Service IRCforex options and futures are some of the contracts subject to forex 1256. Taxation for over the counter traders.

Tweet Share Share. Previous Post FX Premiere Review Next Post Top to bottom approach in stocks investing. Related Posts. What Is the Balance of Payment and Its Impact on Exchange Rate? May 6, How to Use Inverted Candlestick in Trading April 16, How to Spot the Three Rising Valleys in Trading Charts April 14, Next Post.

Leave a Reply Forex 1256 reply Your email address will not be published. Top Managed Accounts. Follow our Twitter. Bonds Investing Crypto Trading Forex Trading Mutual Funds ETFs Investing Real Estate Investing Stock Trading. Online Brokers Robo Advisors Signal Providers. Banking Financial Advisors Money Market Accounts Savings Accounts. PASSIVE INCOME. Automated Trading Managed Accounts Passive Income Apps.

Are you looking for the best investment plan? Let our financial advisors help you Contact Us, forex 1256. PERSONAL FINANCE, forex 1256. Financial Independence Saving Money Paying Off Debt Make More Money. Home Forex 1256 Privacy Policy Disclaimer Contact Us.

Welcome Back! Login to your account below, forex 1256. Forgotten Password? Create New Account! Fill the forms bellow to register. All fields are required, forex 1256. Log In. Retrieve your password Please enter your username or email address to reset your password.

( 6 MAY ) daily forex forecast - EURUSD - USDJPY - GPBUSD - USDCAD - USDCHF - forex - Hindi -

, time: 9:12Filing Forex Trading Taxes IRC vs. IRC Step-by-Step Guide - MyFinAssets

02/03/ · Under section of the Internal Revenue Service (IRC ), forex options and futures are some of the contracts subject to taxation. The two contracts are usually subject to 60/40 tax considerations. In this case, 60% of the gains or losses accrued from either the two are often considered long-term capital gains or losses 30/11/ · Section generally applies to foreign currency futures traded on U.S. exchanges, while other forex contracts fall by default under Section – unless you opt out. More on that in a bit Tax tips for the individual Forex trader - Alpari

No comments:

Post a Comment