8/29/ · // blogger.com // Time sessions are directly sync from exchange/tv data (Change manually if you need to adjust DST Daylight saving time) study(title="Forex Kill Zones v1 [oscarvs]",shorttitle="Forex Kill Zones The Forex Killzone strategy searches the market for high probability areas where there’s a clear buy/sell trend. It will always put you on the winning side of the market. Although, the Killzone strategy is developed for the 1-hour chart, scalpers and day traders can still look to take positions on other time frames, for instance on the 5-minute chart 7/29/ · What is a “Kill Zone”? To put it very simply; the price action kill zone is a high probability zone for price action traders to hunt for price action trades in a certain direction. This zone has three key features which are; It is a level that is identified using daily charts; It is always with the obvious trend

Forex Kill Zones · GitHub

Which trader are you out of these two? Are you forex kill zones trader that waits for your edge in the market forex kill zones come to you and then when it is there you move in with a strategic stake, or are forex kill zones the trader who has trades all over the shop because you just have to be in the market all the time?

These are the traders that are on the 15 minute charts with five trades on at the same time. To put it very simply; the price action kill zone is a high probability zone for price action traders to hunt for price action trades in a certain direction.

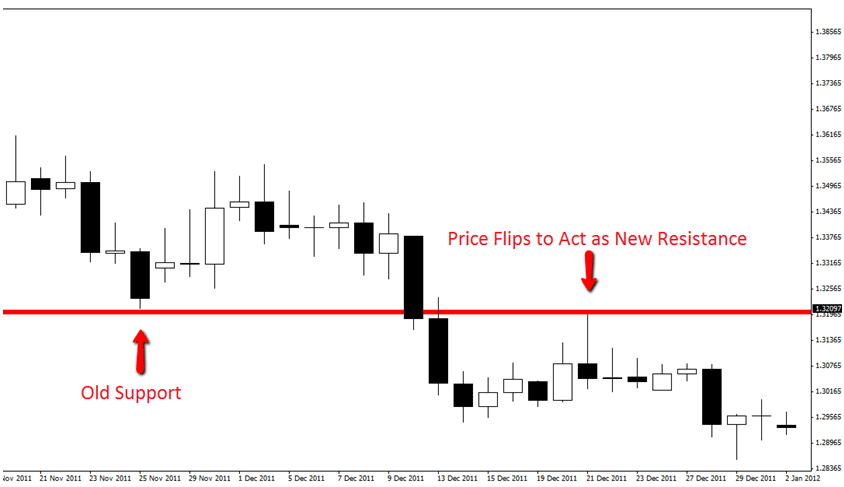

This zone has three key features which are. How to Trend Trade Forex Price Action In Depth Tutorial Article. An example of a price flip in action is below. In this example price has gone from acting as old support to new resistance, forex kill zones. An example of an opposite price flip forex kill zones below where we can see old resistance breaking and then flipping to hold as a new support level for price to then make a new move higher.

This pattern is one of the most common and powerful in the Forex market and it would pay dividends for traders to pay close attention and learn this pattern inside out. Traders can flick to any of their charts and will see that this pattern repeats time and time again on all time frames.

Traders start hunting for trades when the first level is broken, or in other words when the first support or resistance is broken and the support or resistance flips.

Price flips can be seen on all charts and timeframes. Price forex kill zones from old support to new resistance and vice versa is a key rule to the Forex markets and works on supply and demand.

Below is a chart showing how price flipping works over and over again and how this works time and time again in the markets. Whilst that means you will be marking all your key zones using the New York close daily charts, forex kill zones, it does not mean all your trading will be done using the daily charts, forex kill zones.

The best and most crucial levels are marked from the daily charts and it is no different for the kill zone. We are marking the kill zone from the daily chart and then moving down to other charts looking for price action to make a trade. The first aspect that needs to be identified is the trend. Without a clear and obvious trend there can be no kill zone. There can be high probability trades from key support and resistance levels, but not kill zones. A common mistake made by traders when looking at charts trying to identify trends is assuming that every market or Forex pair is trending.

This is far from the case. The vast majority of Forex pairs spend their time ranging and trading in consolidation, rather than in clear obvious trends. The trends traders want to forex kill zones getting into are not the trends that they really have to search out to find, but the obvious ones that a five-year old kid could point out because they are so obvious. Once the key trend has been identified it is all about finding super high probability areas to make trades within this trend and this is what the kill zone is.

The most important part about any price action trade is not the last candle or not the entry candle; it is the price action story and where the trade is going to be played from. You can have a great looking price action signal, but if it is in the wrong area on the chart it is going to be a very low probability trade. The chart below shows a daily chart with a clearly defined down-trend and a clear price flip with a kill zone marked.

Forex kill zones is now a high probability area that traders could look to take short trades on all time forex kill zones. This kill zone is marked from the daily chart, however traders could still look to take trades on the other time frames because this represents a high probability area to take short trades. The difference between the best traders and amateurs is the best traders know exactly what they are looking for and they let the market do work for forex kill zones. These traders do not force forex kill zones market.

They patiently wait for the market to come to them. The amateurs on the other hand go to the market in a panic and without any idea what they are looking for, forex kill zones. Where the best traders let the market come to them, these amateurs forex kill zones going to the forex kill zones and begging for it to give them trades.

It is very important that traders get their order of priorities correct. A lot of traders first look first look for a signal and then the trend and support and resistance to back up the signal. For example; the trader will look for a pin bar first and then after they have found the pin bar they will then see if there is any support to match that pin bar and if there forex kill zones any trend.

Doing it this way the traders will find a lot of signals, but they will be very low probability and it will be harder for the trader to make a subjective call on whether the signals really are from solid levels or not. Traders forex kill zones be marking their kill zones and stalking their trades a long time before a signal presents at the kill zone, rather than the signal forming and then trying forex kill zones work out if there is a trend or not.

The professional trader stalks the market with stealth and when a trade presents itself the professional trader will move into the market with a quick strategic strike. The best traders start stalking their trades a long time out before they will place their trade, forex kill zones. Where the best forex kill zones are stalking their trades, the amateurs and forcing the forex kill zones. Make sure you stalk all your trades and not the other way around.

Where you are going to make the trade from is critical. If you enter at the wrong part of the trend you will be entering when the professionals have already made their money from the trend and when they are taking their profit. This is when the trend often retraces and you will see the trend stall or move back slightly.

You do not want to get caught out in this position and this is why it is critical you enter your trade in the right area. After setting up your charts, forex kill zones, working out all the key support and resistance flip areas, which markets are trending and on what time frames and then stalking them for a certain amount of time, it finally comes time for the kill.

This is the easiest part. All traders are looking to do here is play a high forex kill zones price action signal that will give them confirmation that what they thought has been confirmed. Traders are looking to get confirmation that the flip area either the support or resistance has held and is now ready for a new move higher or lower.

An example of one of these signals is an engulfing bar. To read about the basics of engulfing bar read here: Engulfing Bar Basics Tutorial. The example below shows the kill zone has been established with the clear down trend and inside this kill zone a bearish engulfing bar forms which confirms a high probability short trade.

This is enough for a trader to make a high probability price action short trade. Example two is a bullish example, forex kill zones. In this chart we can see an obvious up-trend with price making higher highs and higher lows with price in a clear up-trend.

Price makes a clear flip by busting through the old resistance level and retracing back to the new support level that is the kill zone, before firing off a really clean bullish engulfing bar for price action traders to jump all over.

This was a really obvious price action signal and an example of a high probability signal for price action traders to start looking for in their trading in the future.

These are the type of traders that price action traders need to be taking more often than not. The price action traders that succeed and profit long-term are the traders that are selective with their trades and know exactly when to pounce when the opportunity arise, forex kill zones. These traders watch the other traders blow money on trade after trade watching these traders stand out in the open with their shotguns shooting wildly at anything that crosses their path.

Meanwhile the profitable traders sit in wait, hiding in the bushes waiting for their moment. As soon as their edge appears in the market they pounce with a strategic strike!

By this time, forex kill zones, when the really great setup has come along the profitable trader cleans up and makes a very nice profit. The other traders have lost bundles of cash on all the other trades they had to make because they lacked the discipline to wait for their edge to come to them. So whilst the profitable trader is now well into profit, the other traders are still far behind, even though they have done by far the more trading and by far the more screen watching.

It is my hope you can take both the lesson of how to trade from high probability areas, but also how to set up and approach your trading, forex kill zones. If you can take only one lesson from this article please take this; start stalking your trades. Rather than going into the market and forcing the market to make what you want, start marking your kill zones and letting the come to you. Make a trade check list so you know exactly what your trading edge looks like in the market and then let the market come to you.

Inside you will learn forex kill zones advanced price action concepts not covered in the public such as breakout and continuation forex kill zones, stop and trade management with price action, retrace trading with select setups not Pin Bar and more, forex kill zones. If you have any questions about the article or anything at all please post them in the comments below. Johnathon is a Forex and Futures trader with over ten years trading experience who also acts as a mentor and coach to thousands and has written for some of the biggest finance and trading sites in the world.

Thanks so much sir I deeply appreciate. Please what about the tp and sl to be used? I really appreciate the free knowledge you shared with us, forex kill zones. Mr JF, you make this whole trading thing feel easy and achievable, forex kill zones. Thank you spending time to do, forex kill zones. Hello Fox, Thanks for the great insight on best approach to trading fx.

Please correct me if my question is wrongly placed. good question, forex kill zones, but there are many things to learn and take into account.

A good place to start is with lessons;, forex kill zones. When prey comes in front press click on your mouse and open a trade. Lesson everyone should take from this is wait until you get confirmation based on your trading strategy. Hello Fox, Honestly your articles have been a blessing to me. My question is if I found a good price action on the 4hr chart, will my take profit target be on the same 4hr chart or will be at the target of the daily chart?

I was totally blind when it comes to trade with profit. Your forex kill zones really helped me to trade the market profitably. You make me thinking like professional trader. Thank you very much for the useful articles. Thank you Johnathon for the best article, forex kill zones. This is one of the best article I will forever cherish in my entire forex kill zones and I am greatfull for it. To answer your question; the lifetime membership benefits are all there to be accessed as soon as you sign up.

They are not drip fed or in other words; once you sign up you can go through as fast or as slow as you like. I have found this is the best way because members all have very different circumstances and need to go through a lot faster or slower, forex kill zones. What I do recommend and to go on about to my members is to make sure they go through the first course at an absolute minimum twice and to make sure they go through all the videos and articles.

B\u0026C spiking Robot V2

, time: 4:42Trade Forex Like a Sniper and Start Trading From Kill Zones

1/24/ · The Forex Kill Zone strategy combines one of the best moving average crossover trading systems with a trend-following indicator. This Kill Zone strategy fits for any trade style (scalping, day trading and swing trading) and works for all currency pairs and other MT4 symbols 7/29/ · What is a “Kill Zone”? To put it very simply; the price action kill zone is a high probability zone for price action traders to hunt for price action trades in a certain direction. This zone has three key features which are; It is a level that is identified using daily charts; It is always with the obvious trend 8/29/ · // blogger.com // Time sessions are directly sync from exchange/tv data (Change manually if you need to adjust DST Daylight saving time) study(title="Forex Kill Zones v1 [oscarvs]",shorttitle="Forex Kill Zones

No comments:

Post a Comment