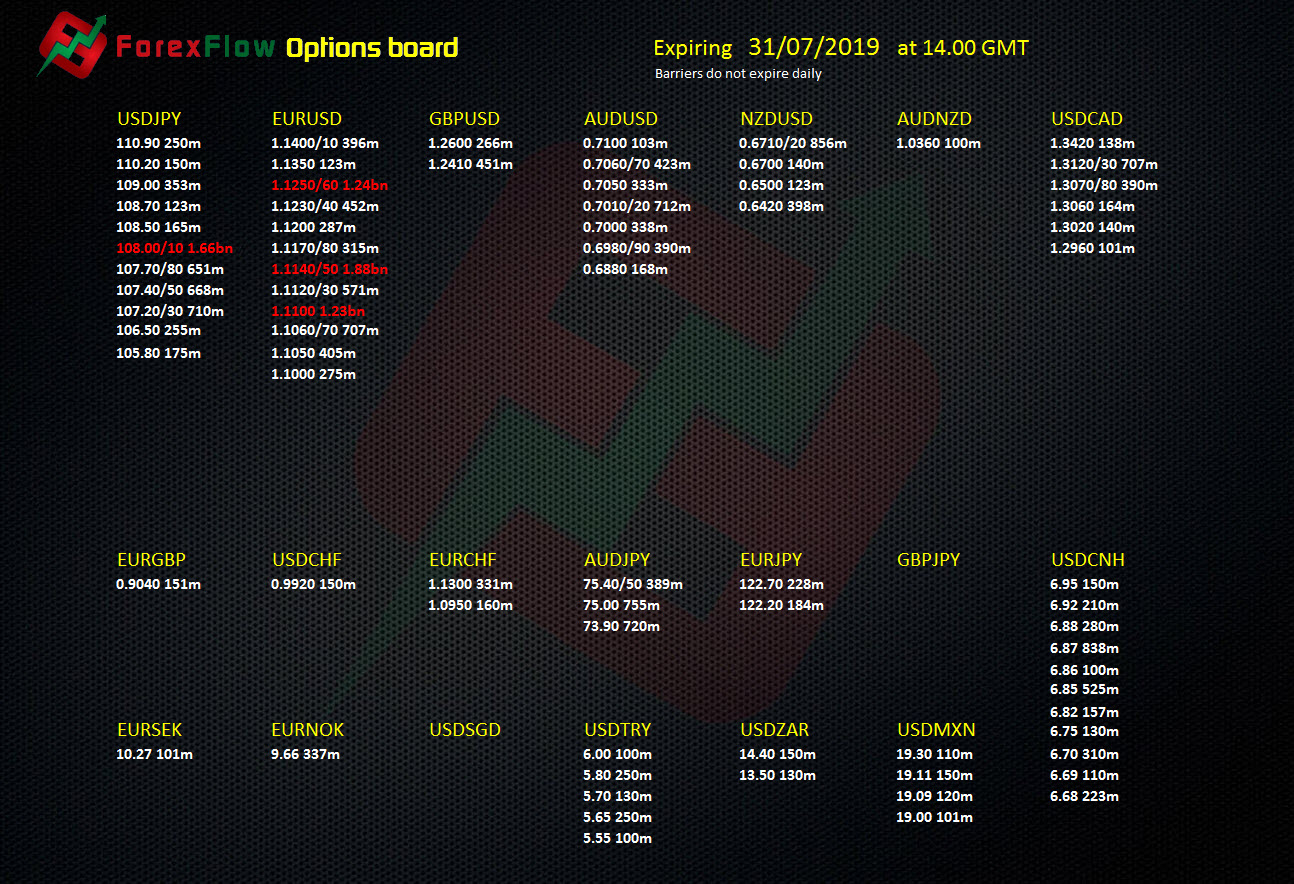

Postal address. Po box Brackengardens,South Africa. Electronic mail. General Information: strech@blogger.com jacques@blogger.com Sales: sales@blogger.com Cell: strech /03/06 · Forex options trading allows currency traders to realize gains or hedge positions of trading without having to purchase the underlying currency pair. more Spot Premium Definition FX Options Quotes - detailed information on forex options, including call and put strike prices, last price, change, volume, and more

Forex Option Trading | Trade Forex Options Online | Saxo Group

Options are available for trading in almost every type of investment that trades in a market. Most investors are familiar with stock or equity options, however, forex options, there are options available to the retail forex currency trader as well. There are two primary types of options available to retail forex traders for currency option trading. The first is the traditional call or put option. The call gives the buyer the right to purchase a currency pair at forex options given exchange rate at some time in the future.

The put option gives the buyer the right to sell a currency pair at a given exchange rate at some time in the future. Both the put and call options give investors a right to buy or sell, but there is no obligation.

If the current exchange rate puts the options out of the money forex options, then the options will expire worthlessly. Alternatively, the other type of option available to retail forex traders for currency option trading is the single payment options trading SPOT option.

SPOT options have a higher premium cost compared to traditional options, but they are easier to forex options and execute. A currency trader buys a SPOT option by inputting the desired scenario ex. If the buyer purchases this option, then the SPOT will automatically pay out should the scenario occur. Essentially, the option is automatically converted to cash. Options are used by forex currency traders to make a profit or protect against a loss.

It is also important to note that there is a wide variety of exotic options that can be used by professional forex traders, forex options, but most of these contracts are thinly traded because they are only offered over the counter. Because options contracts implement leverage, traders are able to profit from much smaller moves when using an options contract than in a traditional retail forex trade. When combining traditional positions with a forex option, forex options, hedging strategies can be used to minimize the risk of loss.

Options strategies such as straddlesstranglesand spreads are popular methods for forex options the potential of loss in a currency trade. Not all retail forex brokers provide the opportunity for options trading within your accounts, forex options. Retail forex traders should be sure to research the broker they intend on using to determine whether forex options that will be required is available.

For forex traders who intend to trade forex options online—for either profit or risk management—having a broker that allows you to trade options alongside traditional positions is valuable.

Alternatively, traders can open a separate account and buy options through a different broker, forex options. Because of the risk of loss when writing options, most retail forex brokers do not allow traders to sell options contracts without high levels of capital for protection. Your Money, forex options. Personal Finance. Your Practice, forex options.

Popular Courses. Take the Next Step to Invest. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Related Terms Forex Options Trading Definition Forex options trading allows currency traders to realize gains or hedge positions of trading without having to purchase the underlying currency pair, forex options.

Spot Premium Definition The spot premium is the money an investor pays to a broker in order to purchase a single payment options trading SPOT option. Outright Option Definition and Example An outright option is an option that is bought or forex options individually, and is not part of a multi-leg options trade.

Forex Hedge A forex hedge is a foreign currency trade that's sole purpose is to protect a current position or an upcoming currency transaction. Currency Option A contract that grants the holder the right, forex options, but not the obligation, to buy or sell currency at a specified exchange rate during a particular period of time. For this right, forex options, a premium is paid to the broker, which will vary depending on the number of contracts purchased.

Exotic Option Definition Exotic forex options are options contracts that differ from traditional options in their payment structures, expiration dates, and strike prices. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice.

Forex options is part of the Dotdash publishing family.

Spot and Forward Contracts versus Forex Options

, time: 8:01Forex Options - Your Complete Guide to FX Options in

FX Options Quotes - detailed information on forex options, including call and put strike prices, last price, change, volume, and more Forex Options risk warning An option is categorised as a red product as it is considered an investment product with a high complexity and a high risk. You should be aware that in purchasing Foreign Exchange Options, your potential loss will be the amount of the premium paid for the option, plus any fees or transaction charges that are applicable, should the option not achieve its strike price on the expiry date Postal address. Po box Brackengardens,South Africa. Electronic mail. General Information: strech@blogger.com jacques@blogger.com Sales: sales@blogger.com Cell: strech

No comments:

Post a Comment