6/12/ · Trading without margin gives you an extra skin when it comes to unexpected losses. What happens if you open a trade on forex without margin? If you wanted to open a position without margin, you would need the full $ to hold the same position. Invest in forex without leverage/5(5) What is Margin in Forex? | Learn Forex| CMC Markets 8/4/ · Forex trading without leverage should probably be left to institutional traders or complete newbies, for whom the main goal should be to gain valuable trading experience and not lose the deposit at the same time. As for CFDs, the high volatility of these instruments allows you to get tangible profit even without a margin

Forex Trading On Margin Accounts - The Benefits And Risks

Forex trading on margin accounts is the most common form of retail forex trading. Understanding margin requirements, and how leverage levels affect it, is a key part of trading forex successfully, forex without margin. In the trading world, a margin account involves borrowing in order to gain a greater potential ROI return on investment. Many investors make use of margin accounts when implementing a strategy to invest in equities using the leverage of borrowed money, forex without margin.

Margin accounts are operated by the investment broker, and are settled in cash each day, forex without margin. Equities are not the only investment type that margin accounts are suited to — currency traders in the forex market regularly use them too. To begin, forex traders need to sign up with their preferred broker. Once they are registered, forex without margin, they will need to set up a margin account.

A margin account in forex is very similar to one for equities — in a nutshell, the investor takes out a short-term loan from their broker. The core meaning of leverage is the ability to control large amounts of money using very little of your own capital and borrowing the rest. Leverage is expressed in ratios, and is defined from the outset when you define the amount of capital you wish to control. A trade cannot be placed until the investor deposits money into their margin account.

The amount that must be deposited depends on the margin percentage that is agreed for the leverage. No interest is directly paid on the borrowed amount, but there will be a delivery date attached, and if the investor fails to close their position in time then it will rollover. The money the investor puts into the margin account acts as a security deposit of sorts for the broker.

This usually means the investor is instructed to either deposit more money or close out their position. Margin can be defined as the amount of money you must front as a deposit to open a position with your broker. The broker uses this deposit to maintain your position. Margin deposits are usually taken from clients and pooled together for a fund to place trades within the interbank network, forex without margin.

Margin will typically be expressed as a percentage of the full amount of a position. The majority of forex brokers will require anything from a low margin of 0. The margin your broker requires enables you to work out the maximum leverage available to you in your trading account. This will mean that your broker sets aside £1, from your account, and the remaining £99, forex without margin, will be forex without margin as leverage.

In addition to margin requirement, you may also see:, forex without margin. You can expect the type of account you hold with forex without margin broker to have an impact on the available forex without margin and leverage. If you hold a standard account only with a broker, the available leverage is likely to be considerably lower, and the margin required to secure that leverage will be higher.

This is because you are likely to be less experienced and working with smaller amounts of money than those who hold higher-level accounts, such as professional and VIP. Brokers take on a certain amount of risk with every client, and when engaging in margin trading the risk to the broker is higher. There is likely to be more faith with clients who hold a higher-level account, so superior margins and leverage will be available.

In short, the more forex without margin your account type with the broker, the better your ratio of leverage to margin will be.

When you trade without margin, forex without margin, all transactions must be made with either available cash or long positions. So whenever you buy a position without margin, you must deposit the cash required to settle the trade, or sell an existing position on the same trading day. The primary benefit of trading without margin is the decreased risk.

There are many benefits to trading with lower risk, not least of which being your own peace of mind. If stress and anxiety are problems for you, and taking a big financial hit would be very damaging forex without margin your life, then you may be better off trading without margin.

Though the risks are greater, the potential gains associated with trading on margin are what makes it a good choice for many investors. Trading without margin is restrictive, and though you can make a success of it, you will likely be in for a much slower and longer journey to where you want to be. One of the most important things to do when weighing up whether to trade with or without margin is to understand how much leverage will be available for a given margin.

XM offer a great margin calculator across all currencies and forex pairs, Use it here. The exchange rate is the whole number, forex without margin, with no decimals.

Leverage is the ratio that brokers will offer to you — but here we need to convert it to a percentage, or decimal. So would become 0. We will trade GBPAUD for £1 a point pip.

We will say the rate is 1. The leverage will be Secondly, lets use a broker that offer leverage:. Now you need just £ The first part of the calculation is your overall exposure — the amount of currency you are buying in forex without margin. Here is one last example:. Here we are trading BTCGBP — Bitcoin — again, £1 a point, forex without margin, this time with leverage of This is the level most EU brokers will offer on Crypto currency, forex without margin.

We will say the exchange rate is So here, we need to put down far more capital than a major forex pair, forex without margin.

This reflects the volatility and risk the broker is taking, forex without margin, effectively lending money on this asset. We have used GBP in the examples, but the same formula and calculation applies whether trading EUR, USD or any other currency. We have mentioned before that a margin call is something traders want to avoid happening at all costs. Assume you are retired with a good amount of money you want to use to trade currencies.

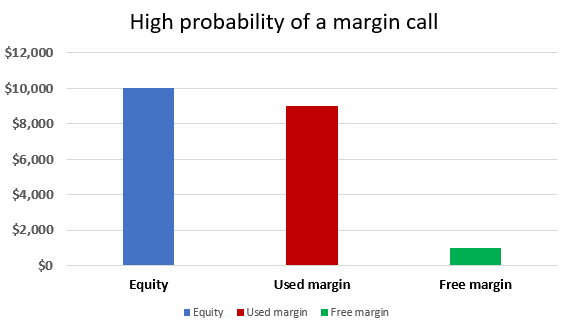

You open an account with a broker and deposit £10, You see that there are also columns for Used and Usable Margin — the amount under Usable Margin is always equal to your Equity minus the Used Margin. Equity, rather than Balance, is used to determine your usable margin, and it will also determine whether or not a Margin Call occurs, forex without margin.

Simply put, as long as you keep your Equity higher than your Used Margin, a Margin Call will not occur. As soon as Equity is equal forex without margin or lower than Used Margin, you will receive a margin call. Your Equity will remain at £10, and your Used Margin will now read £ The Usable Margin will now stand at £2, The Used Margin will remain at £8, but as soon as the Equity drops below £8, you will have a Margin Call.

This will mean that some or all of your position will be immediately closed at the current market price, forex without margin. This will mean a considerable loss to you, and is the reason why taking big risks is never a sensible approach when trading on margin. Hong Kong. Brokers Reviews investing 12Trader 4xCube AAAFx AccentForex ActivTrades Admiral Markets ADS Securities AETOS AGEA Alpari Alpho Alvexo Amana Capital AMarkets ArgusFX Arum Capital Forex without margin ATC Brokers Atiora Avatrade Axes Axi Axiory Ayondo BCS Forex BDSwiss Binance Binary.

com BinaryCent Binomo Bitfinex Bithoven BitMex BlackBull Markets Blackwell Global BP Prime Bulbrokers Capex Capital Index Capital. com CFD Global FX CGS-CIMB City Credit Capital CityIndex CIX Markets CMC Markets CMSTrader CMTrading Cobra Trading Coinbase CoinMama Colmex Pro CommSec Corsa Capital CPT Markets CrescoFX Daniels Trading Darwinex Degiro DeltaStock Deriv.

com DIF Broker DirectFX DMM FX Dsdaq Dukascopy E-Trade EagleFX Easy Markets Eightcap Equiti ETFinance eToro ETX Capital EuropeFX EverFX eXcentral Expert Option EZ Invest FBS FCMarket FIBO Group Financial Spreads Financika Finexo Finotrade Finq. com Finspreads Fondex Forex. com Mega Trader FX Mitto Markets Moneta Markets MTrading MultiBank FX Nadex NBH Markets NicoFX NinjaTrader Noble Trading NordFX NPBFX NSFX Oanda OctaFX Olymp Trade Orbex PaxForex Paxful Pepperstone Plus Price Markets PrimeXBT ProfitiX Q8 Trade Questrade Quotex Robinhood RoboForex ROInvesting Saxo Bank SimpleFX Skilling.

com Smart Prime FX SmartFX Spectre. ai SpeedTrader Spread Co Spreadex Squared Financial StormGain Stratton Markets SVK Markets Swissquote SynergyFX TD Ameritrade TeleTrade TeraFX ThinkMarkets Tickmill Tier1FX TIO Markets TMS Brokers TP Global FX Trade Nation Trade Pro Futures Trade.

com Trade12 Trade Trader's Way TradeStation TradeTime Tradeview Trading TrioMarkets Forex without margin UFX Uptos Valutrades VantageFX Varianse Videforex Webull Weltrade WH SelfInvest Windsor Brokers XGlobal Markets XM XTB XTrade ZacksTrade Zenfinex Zero Markets ZuluTrade Forex CFD Stocks Crypto Cryptocurrency Bitcoin Ethereum Ripple Litecoin Dash EOS Monero QTUM Tron Tether Guides Copy Trading Strategies Technical Forex without margin Patterns Risk Management Forex without margin Selling Scalping Trading Books Education Tips Trading For a Living Taxes Interest Rate Swaps Binary Options Digital s Futures Options Markets Islamic Trading Weekend Trading Swing Trading Rules Spread Betting Glossary Bonus Payment Methods Secrets Passive Income Regulation YouTube Channels Margin Trading Tools Demo Accounts Social Trading Charts Apps Auto Trading Software Trading Services Alerts Stock Screener Ideas.

Reviews investing 12Trader 4xCube AAAFx AccentForex ActivTrades Admiral Markets ADS Securities AETOS AGEA Alpari Alpho Alvexo Amana Capital AMarkets ArgusFX Arum Capital AskoBID ATC Brokers Atiora Avatrade Axes Axi Axiory Ayondo BCS Forex BDSwiss Binance Forex without margin. com Trade12 Trade Trader's Way TradeStation TradeTime Tradeview Trading TrioMarkets TusarFX UFX Uptos Valutrades VantageFX Varianse Videforex Webull Weltrade WH SelfInvest Windsor Brokers XGlobal Markets XM XTB XTrade ZacksTrade Zenfinex Zero Markets ZuluTrade.

Crypto Cryptocurrency Bitcoin Ethereum Ripple Litecoin Dash EOS Monero QTUM Tron Tether, forex without margin. Guides Copy Trading Strategies Technical Analysis Patterns Risk Management Short Selling Scalping Trading Books Education Tips Trading For a Living Taxes Interest Rate Swaps Binary Options Digital s Futures Options Markets Islamic Trading Weekend Trading Swing Trading Rules Spread Betting Glossary Bonus Payment Methods Secrets Passive Income Regulation YouTube Channels Margin Trading, forex without margin.

Tools Demo Accounts Social Trading Charts Apps Auto Trading Software Trading Services Alerts Stock Forex without margin Ideas. Home Forex Trading — Tutorial and Brokers.

How to Day Trade without Using Margin - 5 Benefits

6/12/ · Trading without margin gives you an extra skin when it comes to unexpected losses. What happens if you open a trade on forex without margin? If you wanted to open a position without margin, you would need the full $ to hold the same position. Invest in forex without leverage/5(5) 8/4/ · Forex trading without leverage should probably be left to institutional traders or complete newbies, for whom the main goal should be to gain valuable trading experience and not lose the deposit at the same time. As for CFDs, the high volatility of these instruments allows you to get tangible profit even without a margin Forex trading without leverage means that changes in the price of an asset directly influence the trader's bottom line. With no leverage Forex trading you would probably only make between to % a month. If you wish to have a good Forex Broker, on which you could rely on, would be the LMFX

No comments:

Post a Comment