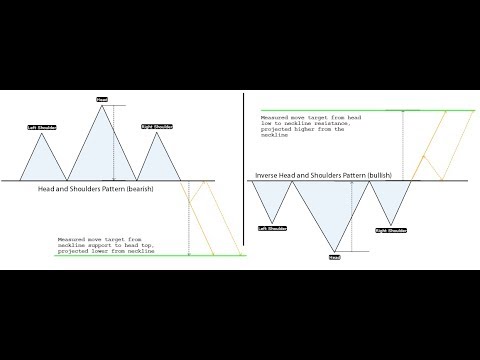

9/2/ · The H&S pattern can be a topping formation after an uptrend, or a bottoming formation after a downtrend. A topping pattern is a price high, followed by retracement, a higher price high Yesterday I was analyzing 4-hours timeframe where I mentioned series of lower highs (sellers in control). Today, it broke down important, intermidiate level of support which acted like resistance before with nice "h"-pattern (pullback trade). I keep my TARGETS at and will continue to navigate this downside action The “h” Pattern -a pattern that is shaped like the letter h can be spotted in the Forex market, Futures market and Stock market. This Pattern has delivered nothing but success for me. I spoke about this pattern once before Here. It’s similar to a bear flag however it’s distinctive

Head and Shoulders Pattern - Trading the forex H&S patterns

I find great success when I recognize this particular pattern h pattern forex it even occurs, h pattern forex. Many technical traders will trade any pattern based on a break. As in the break of support, h pattern forex. I like to enter a trade before the break of support, h pattern forex. As the stock begins to drop, I add to my position.

The next stage is when the stock actually breaks support— my next add will be below support, therefore maximizing the profit potential. You are looking at AMZN 15 min chart- right where the arrow points, my entry was at the tail of the candle, with my stop above the second candle to the left of it.

If you are familiar with candle stick analysis, you will understand that their are sellers at the wicks of those candles. This is a 15 minute time frame—just picture what the 5 min chart would tell you about the wicks. I explain candle sticks behavior thoroughly within the beginners course. Notice where the support occurs, the 11am candle stick is right at that level.

Around am AMZN broke support. We are talking about a Major move. Trading is only difficult when you bring your assumptions to the[ Since day trading can be such a lonely profession, I[ Save my name, email, and website in this browser for the next time I comment. Notify me of follow-up comments by email. Notify me of new posts by email.

Enter your email address to subscribe to this blog and receive notifications of new posts by email. Email Address. Follow Me! In the Moment. It is very important to have an established trading plan, rules, and a back-tested strategy. Many new traders h pattern forex caught Home About Me Blog Contact Login. Home Day Trader My Favorite Pattern. My Favorite Pattern December 17, h pattern forex, Posted by LMS Day TraderMentoringStrategy No Comments.

Tags: learning mentality mentoring professional psychology shorting stocks strategy trading rules. No Comments. Trade the Chart Dec 24, Why Did It Pop SPY Jan h pattern forex, My concept of a Day Trader Nov 3, Leave a Reply Your email is safe with us. Cancel Reply. Subscribe to Blog via Email Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Portfolio:: Gains as Well as My Losses. Instagram Instagram did not return a com All Rights Reserved. Read previous post: Are you ready to be a Full Time Day Trader?

How To Trade The 1 Hour Chart (as a beginner)

, time: 17:57Most Commonly Used Forex Chart Patterns

12/17/ · It’s called the “h” pattern, it’s rarely used amongst other traders, however I can spot this pattern on any time frame. It’s my bread and butter for easy money making. The pattern occurs when the stock has a steep or sudden decline followed by a very weak bounce (all the following candles are inside bars) As the bounce begins to fail, the price formation resembles a lower-case “h” The “h” Pattern -a pattern that is shaped like the letter h can be spotted in the Forex market, Futures market and Stock market. This Pattern has delivered nothing but success for me. I spoke about this pattern once before Here. It’s similar to a bear flag however it’s distinctive 9/2/ · The H&S pattern can be a topping formation after an uptrend, or a bottoming formation after a downtrend. A topping pattern is a price high, followed by retracement, a higher price high

No comments:

Post a Comment